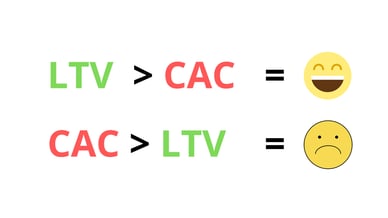

Two indispensable metrics, the cost of acquisition (CAC) and the LTV

Index Content

In the world of ecommerce, metrics are necessary to ensure the success of the business. The LTV or customer lifetime value and the CAC or cost of acquisition are ratios of information that must be present to establish the direction of investments. The LTV bases its data on the projection of the average income of the user during its stages in the sales funnel. In other words, it makes an approximation of the profit that the company will have until the customer stops being a customer. It serves to know the growth of the brand as it informs on how much money can be invested in the acquisition of the customer without losses. To find out the LTV the metric usually focuses on data such as the frequency of purchase or customer lifetime among others.

On the other hand, the CAC indicates how much it costs to convert the user into a customer. Advertising platforms offer this data when the company uses their services. It will help to focus marketing actions in a way that there are no financial losses. Although the CAC and LTV reflect interesting data separately, long-term profitability is achieved by analysing both results and developing a digital marketing strategy to drive business growth.

what is the balance between CAC and LTV?

To match KPIs to a business it is key to know the balance between CAC and LTV. The first step is to know the ratio of LTV and CAC, i.e. the division between both values (LTV/CAC = Ratio). Once obtained, it is difficult to establish what the balance is as recommendations may vary depending on the industry or marketing strategy. However, one thing that is fixed is that LTV should always be higher than CAC. With this in mind, the ratio reveals some information:

- If it is 1:1 the business is at break-even.

- If it is 2:1 there is little profitability, but it is on track.

- If it is 3:1 it is profitable and stable.

- If it is 4:1 the business is performing optimally and the first profit threshold has been exceeded.

- If it is 5:1 the profitability is very high and it is time to invest more in the business.

what is CAC Payback?

what is CAC Payback?

CAC Payback is the time it takes for a company to recover its CAC losses. For example, if you have invested 300 euros to convert a user, but generate 25 euros of profit per month, the payback period is 12 months. This value is necessary to determine the effectiveness of the company's acquisition strategy. If the period is short, it means that the strategy is working financially. Also, the faster the payback, the sooner you can invest again. The length of the payback period will be determined by factors such as:

- CAC: The higher the CAC, the longer the investment period, so it is worth taking a low cost risk and replenishing it as the customer brings in long-term benefits.

- Monetisation: The customer's payment plan directly influences the CAC PayBack, whether it is a one-off payment, instalments or an individualised plan.

what is churn?

The churn rate shows the percentage of users who have stopped using a company's services. This term is often associated with email marketing, but can refer to any other area of business. It can be complemented with the CAC and LTV ratio to give a complete picture of the user experience and find out which strategies need to be optimised. To reduce the churn rate, there are a few practices:

- Update website content.

- Rethink the marketing strategy.

- Find out what are the weaknesses that cause abandonment.

_page-0001.jpg?width=372&name=Presentaci%C3%B3n%20de%20Educaci%C3%B3n%20Colores%20Pastel%20Cuadr%C3%ADcula%20y%20Tablas%20Resultados%20de%20Experimento%20(1)_page-0001.jpg) how to calculate the CAC?

how to calculate the CAC?

The calculation of the CAC is very simple: it is the division of the sum of investments by the number of converted customers. If the company invests 3,000 euros in customer acquisition actions and succeeds in converting 10 customers, the CAC is 300 euros.

In the calculation, the expenses in the areas of marketing and sales must be included. Thus, expenses in the areas of product development, administration or SAC must be disregarded. Some of the investments that have an influence are the following:

- Salaries of workers.

- Purchase of tools.

- Purchase of advertising.

- Events.

- Software subscriptions.

- Office supplies.

how to reduce CAC?

To improve the CAC, marketing strategies should focus on reducing it. The less you spend on acquiring customers, the more profitability you will get from your business. This translates into the possibility of investing in other areas of the company such as infrastructure or equipment. Some of the strategies that can be adopted to increase efficiency in marketing and sales are:

Using Inbound Marketing

Inbound Marketing strategies are characterised by generating achievable and stable results over time. It focuses on content and SEO optimisation. This achieves the attraction of the public organically. The relationship with the leads is fundamental to ensure that they go through the sales funnel until they make a purchase.

Implementing content marketing

Content marketing is closely related to Inbound Marketing. Improving the content of the company is essential to capture the attention of customers and achieve customer loyalty. Strategies such as creating a corporate blog will help to raise awareness of your brand and strengthen the relationship with the user.

how to calculate the LTV?

To know the LTV you must have the average customer ticket, average purchases per year and average retention time. When these data are obtained, they must be multiplied together to obtain the LTV as follows:_page-0001%20(1).jpg?width=400&name=Presentaci%C3%B3n%20de%20Educaci%C3%B3n%20Colores%20Pastel%20Cuadr%C3%ADcula%20y%20Tablas%20Resultados%20de%20Experimento%20(2)_page-0001%20(1).jpg) For example, the company has an average ticket of 500 euros, 10 transactions in a year and a retention time of 2 years. The formula would be as follows: (500 x 10) x 2 = 10,000 euros will be the LTV of the company's customers.

For example, the company has an average ticket of 500 euros, 10 transactions in a year and a retention time of 2 years. The formula would be as follows: (500 x 10) x 2 = 10,000 euros will be the LTV of the company's customers.

how to improve LTV?

Improving the LTV means increasing the LTV figure. To achieve this, certain marketing strategies must be implemented to increase the value of the average ticket and improve the customer-company relationship. Some of these actions can be:

Increase the quality of the product/service

To ensure product sales and customer retention, it is important to provide a good user experience. The brand must differentiate itself from the competition by offering good quality products in the shortest possible time.

Improve the user experience

What the customer thinks of the company is key to ensuring customer loyalty, so focusing on improving the adaptability of the website, the design or the communication channel will ensure customer satisfaction.

Upsell or cross-sell strategies will serve to increase the customer's average ticket. Upsell will identify if the customer is willing to pay more for a product and cross-sell will try to increase the user experience by getting them to buy complementary products.

3 key elements in LTV

Repurchase rate

This is the number of purchases a customer generates over a period of time. The higher the LTV, the higher the repurchase rate. Implementing the right customer service, discount coupons or segmenting users will improve the repurchase rate.

Average ticket

The average ticket is necessary to calculate the LTV and should be improved by the sales department using upselling and cross-selling, providing free shipping or redefining the product packaging.

Customer retention

Retaining customers is important to increase business revenue. Increasing the retention rate can be achieved by taking care of customers, listening to their complaints and suggestions or improving their user experience. Facilitating the shopping experience will make users choose a certain brand because of its speed in obtaining a service.